ClearSale Pricing Explained: What You Need to Know in 2025

Understanding ClearSale's Value Proposition

ClearSale emerged as a leading fraud prevention solution following Experian's $350 million acquisition in April 2025, combining 20+ years of expertise with enhanced global capabilities.

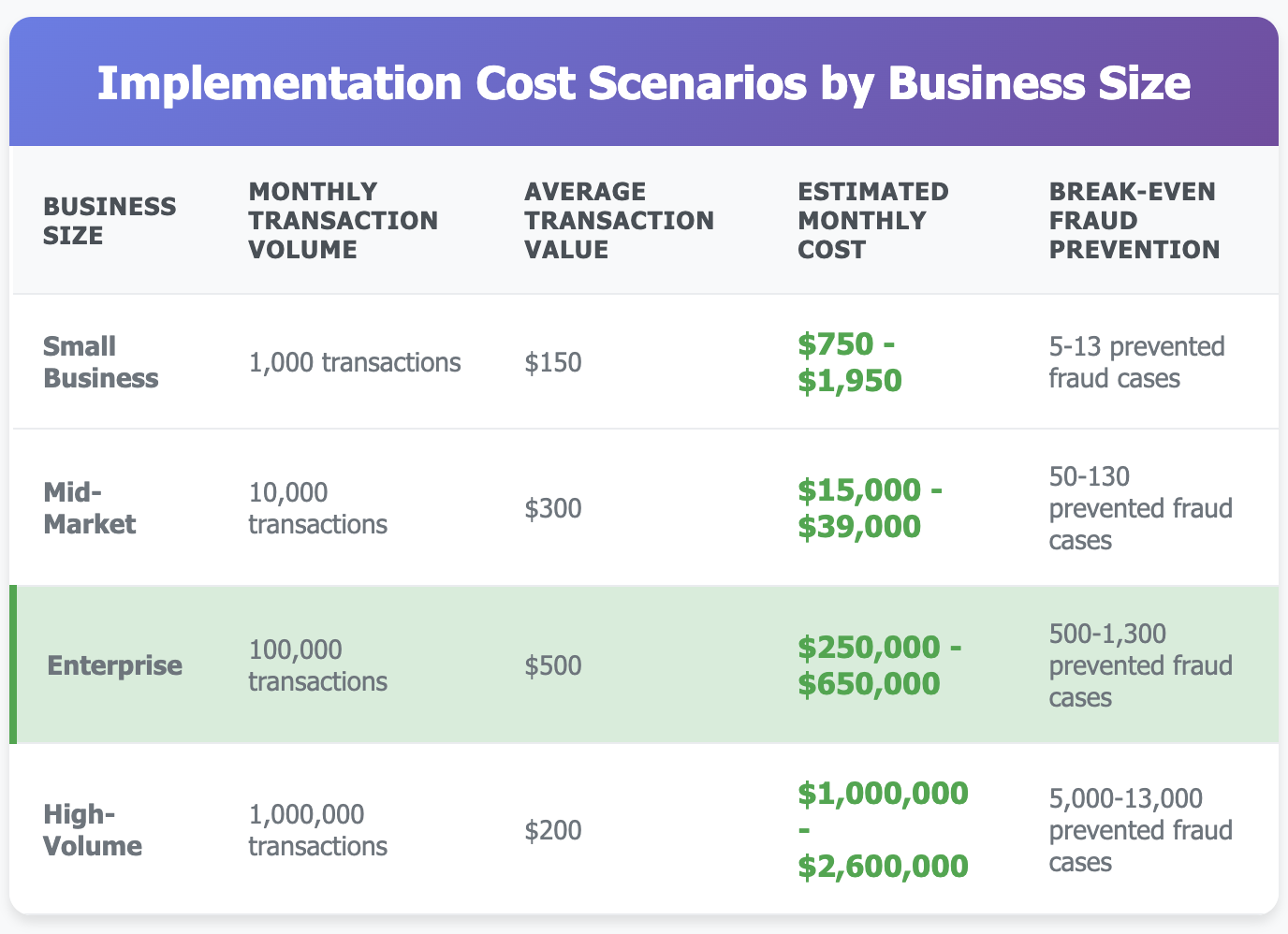

For B2B professionals evaluating fraud protection, ClearSale offers performance-based pricing from 0.5-1.3% per approved transaction with no setup fees or long-term contracts.

ClearSale operates as a fully managed fraud prevention service that combines AI-powered statistical algorithms with human expertise to deliver industry-leading approval rates while providing chargeback guarantees.

Founded in Brazil in 2001, the company has processed transactions across 160+ countries and serves 6,000+ merchants globally, from SMBs to Fortune 500 companies including ASUS, Motorola, and Microsoft.

The unique value lies in being the only major fraud prevention company offering chargeback guarantees at scale, combined with performance-based pricing that aligns costs with results. Their approach eliminates the need for internal fraud teams while delivering measurable ROI through reduced chargebacks and increased approval rates.

Current Pricing Models and Structure

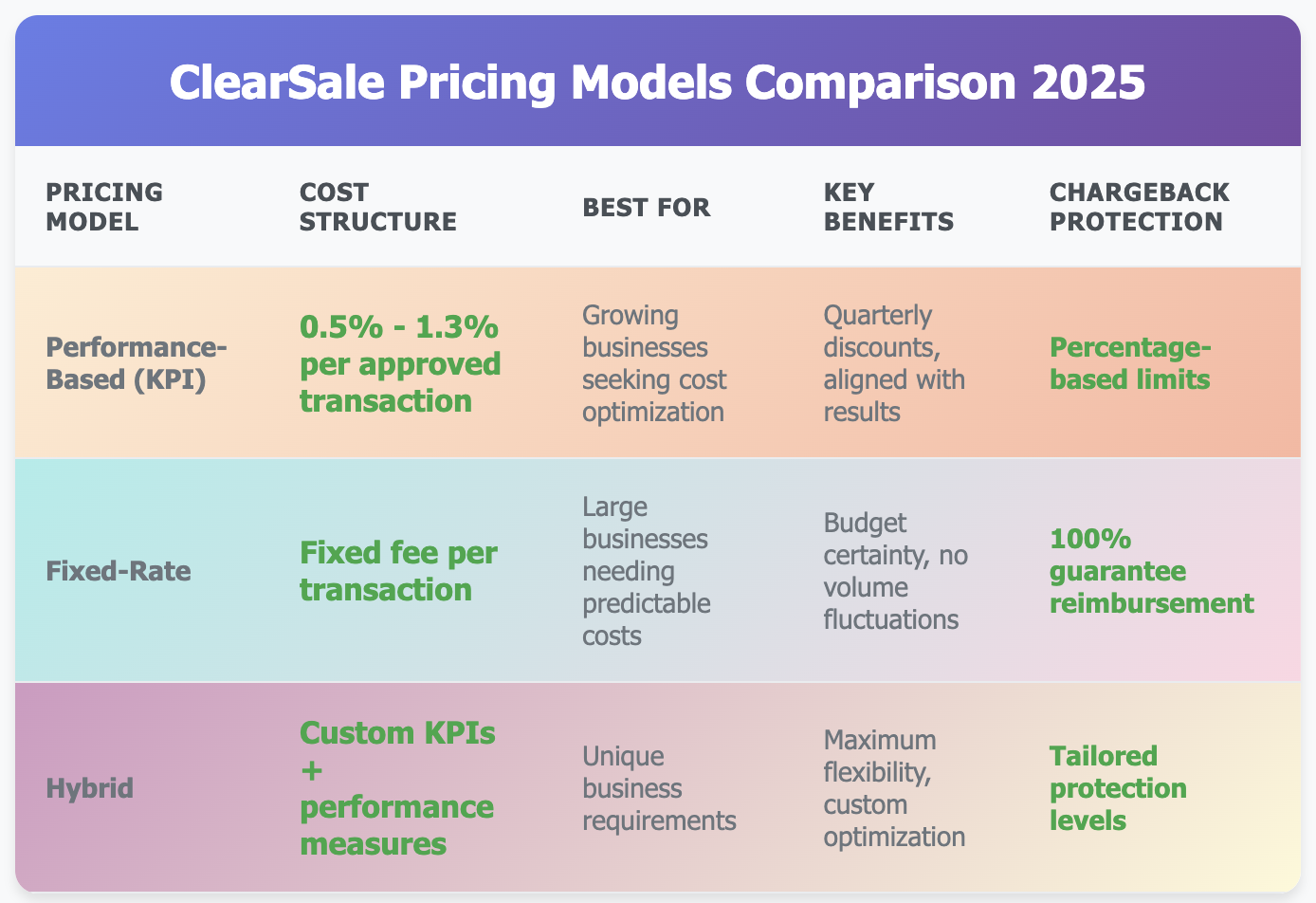

Three Flexible Pricing Approaches

Performance-Based (KPI) Model represents ClearSale's most popular option, charging 0.5% to 1.3% of each approved transaction's value.

This model includes predetermined chargeback percentage limits with quarterly discounts if KPIs are exceeded. The pricing varies based on transaction volume, industry risk profile, and business goals.

Fixed-Rate Model offers predictable per-transaction fees regardless of approval status, determined by sales volume, business goals, and risk profile. This model includes 100% chargeback guarantee reimbursement for fraud-related chargebacks, making it popular with larger businesses requiring predictable costs.

Hybrid Model combines custom KPIs and performance measures, with pricing restructuring available as KPIs are consistently met. This approach ensures the investment "pays for itself" through improved approval rates and reduced chargebacks.

Cost Structure Advantages

ClearSale eliminates common industry pain points by offering:

- No setup fees

- No monthly minimums

- No long-term contracts

- 30-day satisfaction guarantee

- Volume discounts for high-transaction businesses

This contrasts favorably with competitors like Signifyd, which typically requires $1,500/month base fees plus transaction costs and annual contracts.

Service Tiers and Decision Framework

Preventative Intel Portfolio (2024)

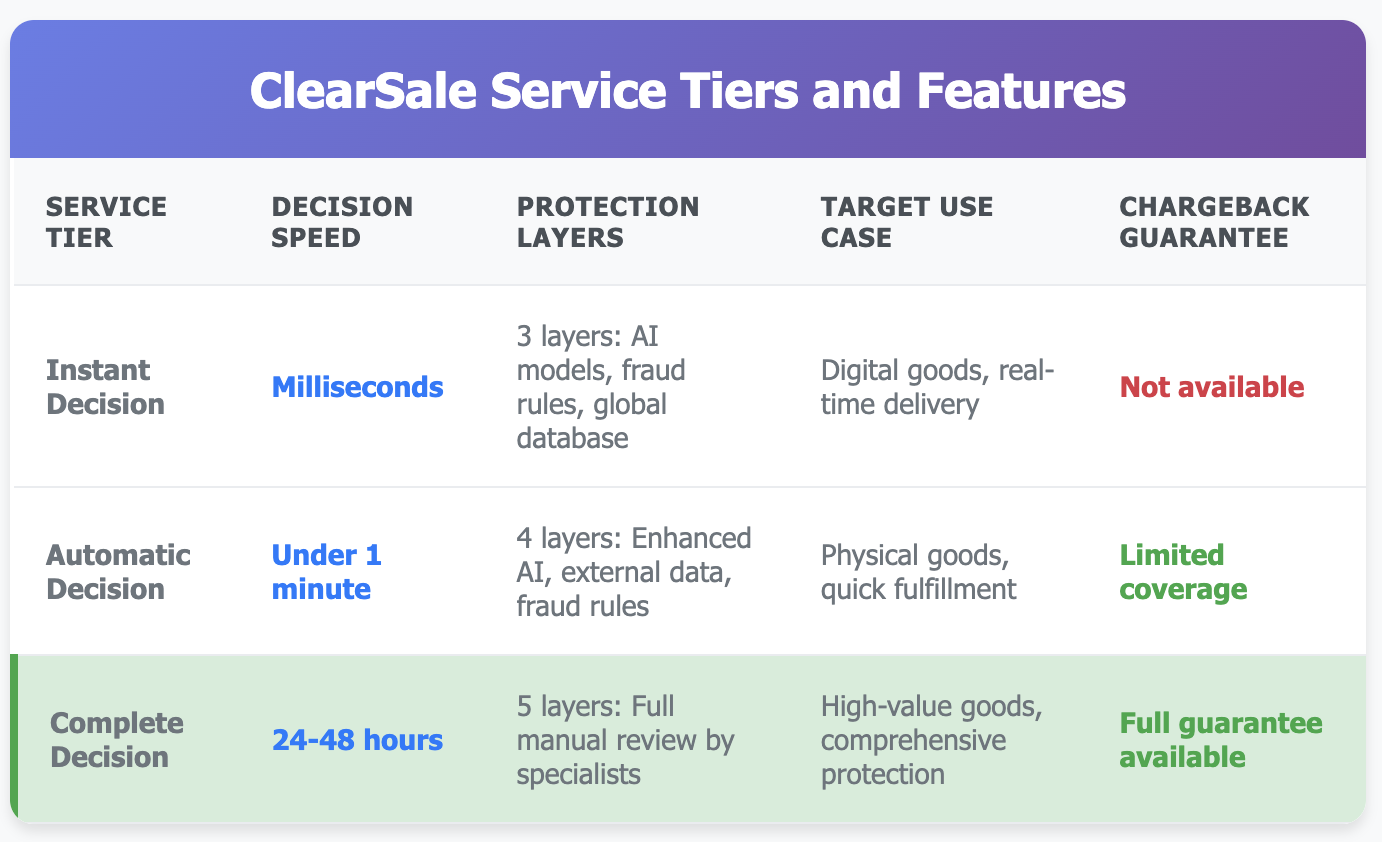

ClearSale launched three distinct service tiers in 2024 to address different business needs:

Instant Decision targets digital goods retailers requiring real-time approval, delivering decisions in milliseconds through three protection layers: AI models, fraud rules, and ClearSale's global database.

Automatic Decision serves businesses with physical goods requiring quick turnaround (under 1-hour delivery/pickup), providing decisions in under one minute through four protection layers including enhanced AI and external data sources.

Complete Decision caters to high-value goods merchants with 24+ hour delivery windows, offering the most comprehensive protection through five layers including secondary manual review by specialized analysts. This tier includes eligibility for ClearSale's chargeback guarantee.

Features Included Across Tiers

All tiers include core platform capabilities:

- Device fingerprinting

- Behavioral analytics

- Real-time risk scoring

- Global fraud database access

- Seamless integration with major e-commerce platforms

Enterprise customers receive additional benefits including dedicated account management, custom rule engines, white-label solutions, and advanced API features.

Competitive Positioning and Market Context

Market Positioning Analysis

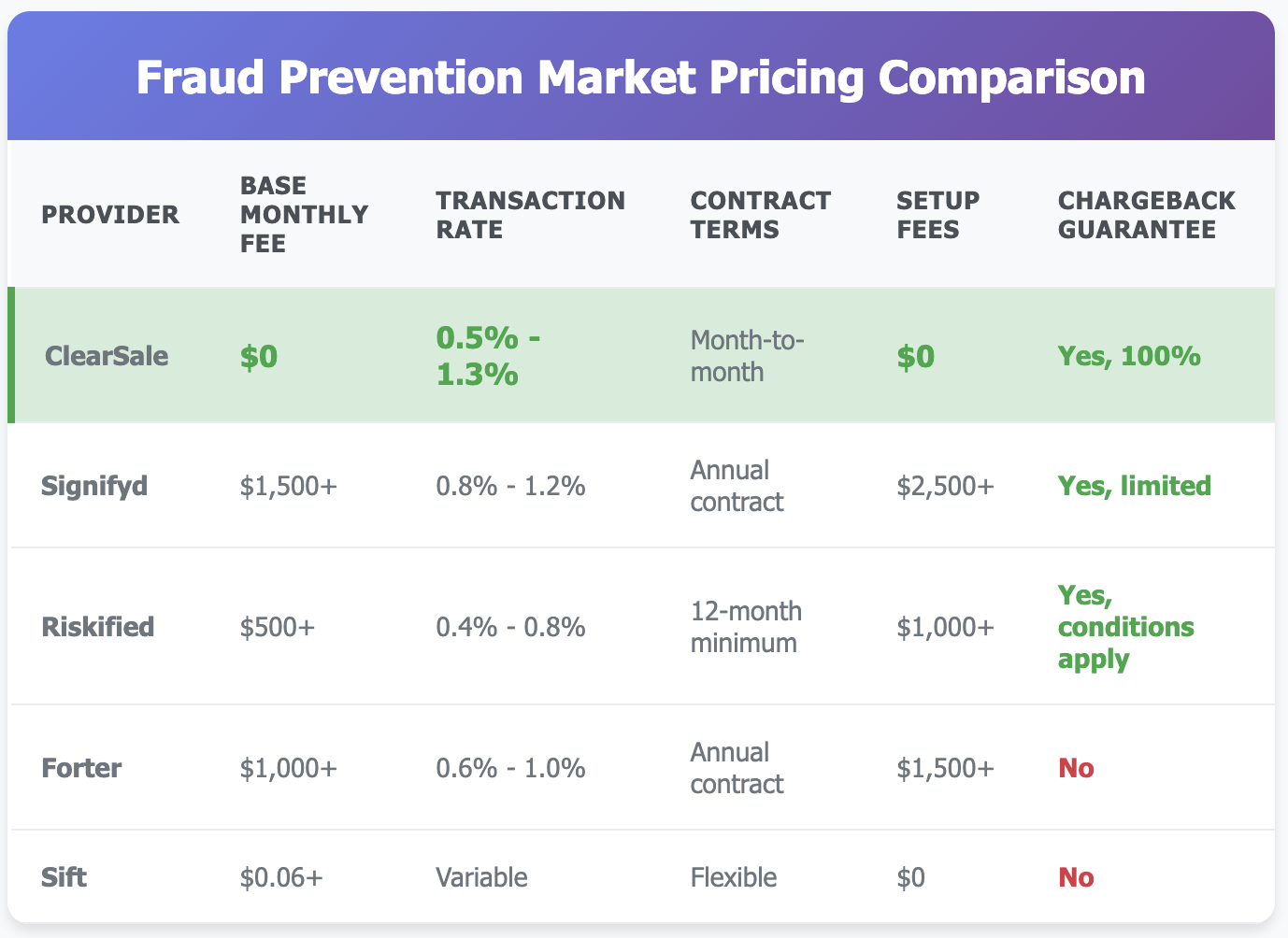

ClearSale occupies the mid-market pricing tier within the fraud prevention landscape, positioned between premium solutions like Signifyd ($1,500/month + 0.8% per transaction) and value-focused options like Sift (starting at $0.06/month).

Against Signifyd, ClearSale offers comparable results at significantly lower total cost by eliminating base monthly fees while providing similar approval rates and chargeback protection.

Against newer players like Forter and Sift, ClearSale leverages proven track record, established customer base, and performance-based pricing flexibility. The key competitive advantage lies in offering both automation efficiency and human expertise without requiring long-term commitments.

Industry Benchmarks and Standards

The global fraud prevention market reached $52.82 billion in 2024 and is projected to grow to $246.16 billion by 2032. Industry benchmarks show direct fraud losses average 0.9% of revenue, while fraud prevention costs average 1.6% of revenue, totaling approximately 2.5% revenue impact.

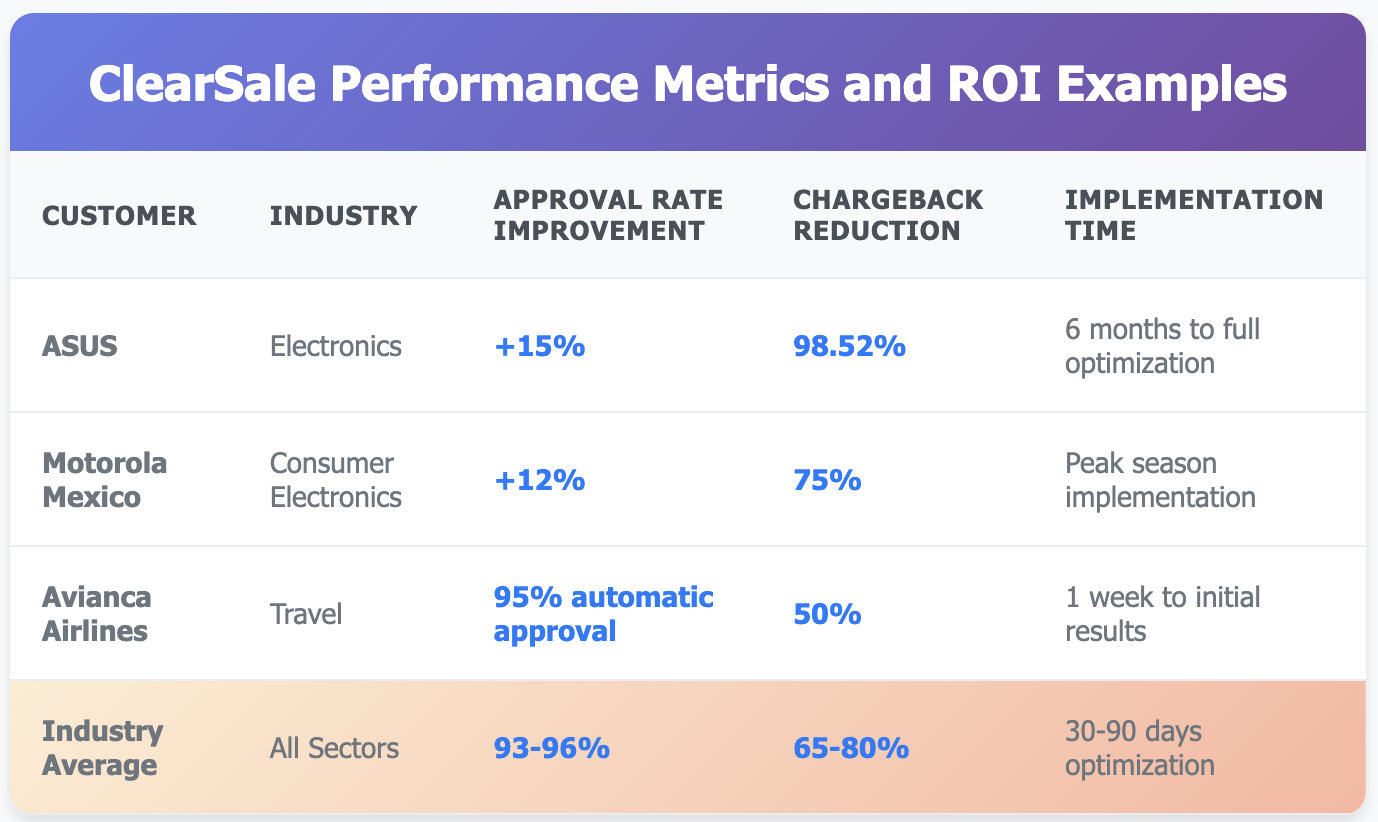

ClearSale's pricing falls within industry standards while delivering superior performance metrics: 91%+ automatic approval rates, up to 98.52% chargeback reduction, and 60% average chargeback rate improvement.

Real-World Pricing Examples and ROI

Customer Success Case Studies

ASUS achieved 98.52% chargeback reduction within six months using ClearSale's Total Guaranteed Protection, eliminating sophisticated fraud schemes including package interception at post offices. The investment freed internal teams to focus on business growth rather than fraud management.

Motorola Mexico implemented ClearSale's custom statistical model at zero extra cost during peak sales periods (Black Friday, El Buen Fin), achieving significant chargeback rate improvements while maintaining high approval rates.

Avianca Airlines reached 95% automatic approval rates and 50% chargeback reduction in the first week through airline-specific risk modeling that analyzed airport connection patterns.

Quantified ROI Framework

Typical performance improvements include:

- 93-96% average approval rates

- 65-80% false decline reduction

- Up to 98.52% chargeback reduction

- $11,000+ monthly fraud avoidance

- 5% approval rate increases from platform integration

The ROI calculation encompasses revenue protection through prevented chargebacks, revenue increase from higher approval rates, cost reduction by eliminating internal fraud teams, and improved customer satisfaction through reduced false declines.

Implementation Guide for B2B Decision-Makers

Evaluation Framework

Business fit assessment should consider:

- Transaction volume (benefits increase with scale)

- Risk profile (high-risk industries see greatest impact)

- Geographic reach (valuable for international sales)

- Current fraud rates (higher baseline enables greater savings)

Technical requirements evaluation includes platform compatibility, decision speed needs, reporting requirements, and integration complexity.

Financial evaluation encompasses current fraud costs, false decline impact, internal resources, and growth plans.

Implementation Timeline and Process

Phase 1 Setup can be completed same-day to 10 minutes for platform integrations, with pre-built plugins for major e-commerce platforms and RESTful APIs with sandbox testing environments.

Phase 2 Customization takes 1-2 weeks, including statistical model training, fraud rules configuration, KPI establishment, and team training.

Phase 3 Optimization represents ongoing improvement through continuous AI model learning, real-time KPI tracking, and quarterly business reviews.

Best Practices for Success

Implementation success factors include:

- Treating ClearSale as a strategic partner rather than vendor

- Providing comprehensive transaction and customer data for model training

- Maintaining regular communication through performance reviews

- Allowing 30-90 days for full optimization

Common pitfalls to avoid include setting overly conservative initial rules, insufficient integration reducing effectiveness, unrealistic timeline expectations, and limited collaboration.

Strategic Recommendations for 2025

Optimal Use Cases for ClearSale

ClearSale is ideal for:

- High-risk industries (electronics, fashion, travel, luxury goods)

- Growing businesses needing scalable fraud protection without internal overhead

- International merchants dealing with complex cross-border fraud patterns

- Customer-centric brands that cannot afford false decline reputation damage

- Volume businesses where per-transaction pricing becomes cost-effective

Decision Timeline Considerations

Immediate implementation is possible through platform integrations available same-day, while seasonal planning should implement 30-60 days before peak sales periods. Growth preparation involves scaling prevention capabilities ahead of expansion.

2025 Market Outlook

The Experian acquisition positions ClearSale for enhanced capabilities through integrated identity verification, expanded global data sources, and stronger compliance capabilities. This strategic move influences pricing competitiveness while maintaining core differentiators of flexible contracts and performance-based models.

For B2B professionals evaluating fraud prevention solutions in 2025, ClearSale represents a balanced approach combining proven technology, human expertise, and flexible pricing models that align costs with results. The combination of no long-term commitments, chargeback guarantees, and demonstrated ROI makes it particularly attractive for businesses seeking comprehensive fraud protection without operational complexity.

The key to maximizing ClearSale's value lies in understanding your specific fraud risks, transaction patterns, and growth plans, then selecting the appropriate service tier and pricing model that aligns with business objectives while providing measurable protection against fraud losses.

Subscribe to Our Newsletter

To Never Miss a Thing

.avif)